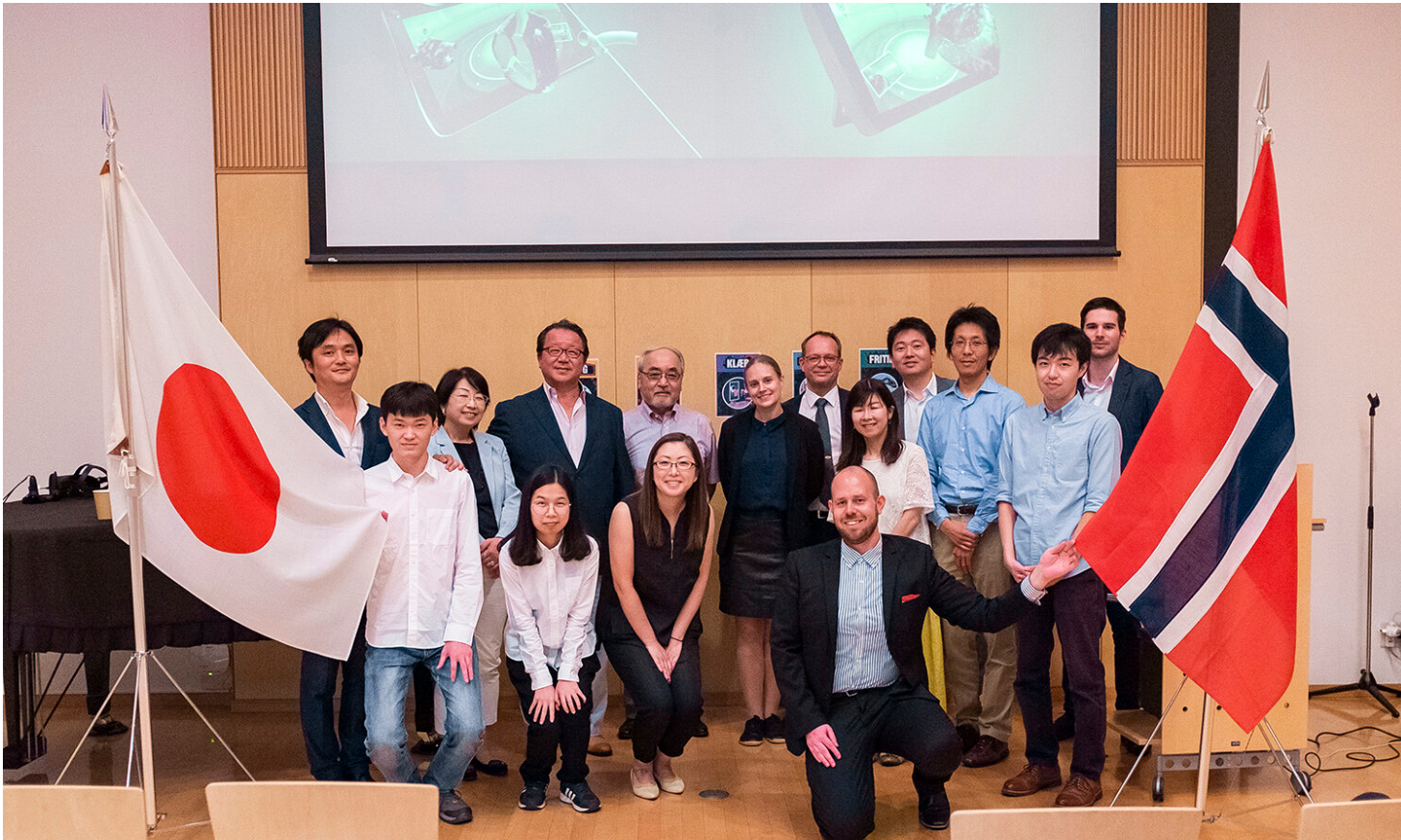

SpareBank 1 Østlandet has been successful with its AR app, which aims to give young people a better understanding of finance. The solution is now exported to schools in the technology nation of Japan.

The application was introduced in 2018 as part of the bank’s financial education for young people in schools. It was very well received by both students and teachers, and was also well received outside the borders of Norway. Now the interest has become so great that Japanese schools also want to use the app.

“It’s a funny thing that locally developed technology is so noticeable. It is not every day that Norwegian technology is exported to technology-heavy Japan. We want to be an innovative bank, and this is confirmation that we are way ahead”, says Christian Fjestad, head of innovation at SpareBank 1 Østlandet.

In partnership with EON Reality

The renowned EON Reality Norway was the technology and development partner of SpareBank 1 Østlandet for the App. They are also locally based in the region. Through an agreement with AVR Japan, they will be responsible for the actual distribution in Japan.

“The app will be launched in October for Japanese schools. Although Japan is a high-tech country, its school system is still dominated by traditional teaching methods. This app will therefore be both an innovative and exciting addition for Japanese students and teachers. We are looking forward to it and are very excited about the reception”, says Knut Henrik Aas from EON Reality Norway.

Uses both AR technology and “gamification”

Thousands of children and young people in schools and with teams and clubs in Eastern Norway have used the app. It is an important part of the bank’s sustainability work, one of the aims of which is to help children and young people get the best possible grip on their personal finances as they grow older. The fact that the app uses AR (Augmented Reality) technology and elements from the game world (gamification) gives young people an inspiring insight into topics such as career choice and salaries, budgeting, consumption and saving.

“The feedback from schools and users is exclusively positive. They report that this is a fun and engaging way to learn about a topic that may seem dry and boring at first. That is good to hear. We see the contribution to a good personal economy among young people as an important part of our social mission,” says Fjestad.

Here you can see the App in use at Grue school

Finans Norge: Norwegian financial industry among the world leaders

“Technological development is very important to the Norwegian financial and banking industry, and the Norwegian financial industry has long been one of the world’s leading companies when it comes to digitalization, efficiency and innovative solutions. This development has been taking place tirelessly since the 1980s, when people started to read giros on a machine”, says information director Tom Staavi from the industry organization Finans Norge.

“The Norwegian financial industry, together with the public sector, has also made it much easier to exchange data in a secure way, which saves society billions of kroner every year. The much-discussed PSD2 directive has accelerated the banks’ innovation work and made banking even easier for customers,” says Staavi.

Staavi thinks it is pleasing, but not so surprising, that the technology developed by Norwegian banks and insurance companies is beginning to conquer a market outside Norway. “Vipps is one example with declared foreign ambitions, the AR app is another. The fact that such a technology-heavy country as Japan is using a technology developed in Hamar is of course an indictment of Sparebank 1 Østlandet. It shows that with good ideas and sound knowledge, it is possible to develop digital services that also bring great benefits to users outside Norway. Sparebank 1 Østlandet has proven that the distance between Hamar and Tokyo is not so great in the digital world, it is inspiring,” concludes Staavi.